South Korea’s Stock Market Surges as Global Investors Bet on AI, Semiconductors, and Corporate Reform

South Korea’s stock market is attracting global attention, fueled by a rally in semiconductor shares, AI-driven optimism, and sweeping reforms to improve corporate governance. The KOSPI and KOSDAQ indexes are outperforming regional peers amid renewed investor confidence.

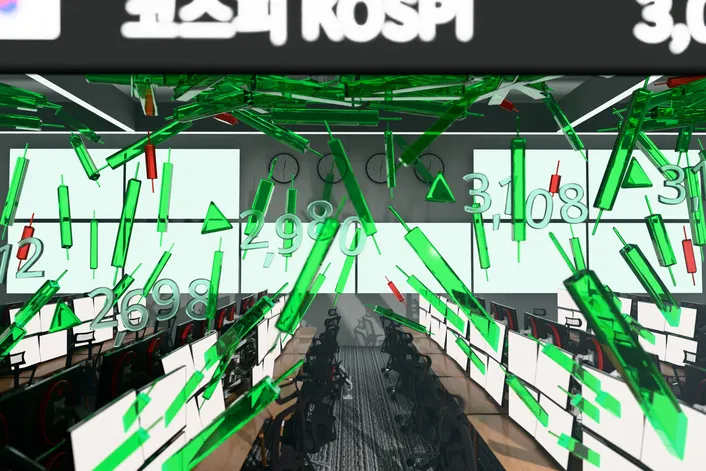

South Korea’s stock market is experiencing a resurgence not seen in years, as global investors pour capital into the country’s benchmark indexes amid booming semiconductor exports, artificial intelligence optimism, and structural reforms to address longstanding governance issues. The Korean Composite Stock Price Index (KOSPI) and the tech-heavy KOSDAQ have rallied significantly in the first half of 2025, outperforming most Asian peers and reasserting South Korea’s relevance on the global financial stage. ### The Numbers Tell the Story

As of July 2025: - The KOSPI is up over 20% year-to-date, hitting its highest level since 2021.

- The KOSDAQ, dominated by growth and tech names, has surged nearly 35%. - Foreign institutional inflows have exceeded $9. 4 billion since January, marking a sharp reversal from outflows in recent years.

This bullish trend has been driven by a confluence of macroeconomic shifts, industry-specific tailwinds, and government-led initiatives aimed at making South Korea a more investor-friendly destination. ### AI and Chips: The Core of Korea’s Market Momentum

At the heart of this resurgence is the explosive demand for semiconductors and artificial intelligence infrastructure. South Korea is home to two of the world’s leading chipmakers — Samsung Electronics and SK Hynix — both of which have seen their share prices soar as global tech giants ramp up spending on AI data centers, smartphones, and edge devices.

Samsung, in particular, has made headlines with its 3-nanometer chip technology and next-gen high bandwidth memory (HBM) tailored for AI training models like ChatGPT and Gemini. Meanwhile, SK Hynix is riding the wave of generative AI with strong demand for its DRAM and NAND flash chips optimized for cloud computing. These chipmakers are now seen as essential suppliers in the AI arms race, and foreign investors are returning to Korean equities in search of exposure to the global tech supply chain beyond U.

S. -listed firms like Nvidia and AMD. ### Corporate Reform: The ‘Value-Up’ Program

In addition to tech-fueled optimism, investor enthusiasm has been further buoyed by the Korean government’s launch of a “Corporate Value-Up” program, which aims to: - Improve corporate governance transparency - Encourage higher dividend payouts - Incentivize companies to increase return on equity (ROE) - Reduce the so-called “Korea Discount” — a term used to describe the persistent undervaluation of Korean stocks due to opaque ownership structures and conglomerate (chaebol) dominance

The initiative has drawn comparisons to Japan’s corporate reform efforts that began in 2014, which helped fuel a decade-long stock market boom.

Korea’s Finance Ministry has signaled that compliance with Value-Up guidelines may be tied to tax benefits and broader regulatory incentives. Some of the key changes already visible: - Several chaebol groups have begun unwinding complex cross-shareholdings. - Shareholder-friendly practices such as share buybacks and dividend hikes are on the rise.

- Retail and foreign shareholders are gaining more voting influence. These measures have boosted confidence among institutional investors who previously avoided the Korean market due to governance risks. ### Retail Boom: The Rise of the Korean Investor

While foreign inflows have grabbed headlines, retail investors — often referred to locally as “ants” — continue to play a pivotal role in shaping market sentiment.

Over 12 million South Koreans now actively trade stocks, up from 6 million just five years ago. Fueled by mobile trading platforms, zero-commission brokerages, and social media-driven investing communities, retail participation in IPOs and tech names has remained strong. Companies like Naver, Kakao, and Lotte Energy Materials have seen broad retail support amid AI integration and sustainability initiatives.

Retail investors are also showing more sophistication, with increasing interest in: - ETF diversification - Global ADRs and tech sector alignment - ESG-focused Korean companies

### Geopolitics and Global Rotation

Amid growing geopolitical tensions in China and regulatory uncertainty in emerging markets like India, South Korea is benefiting from what analysts call a “global capital rotation” toward relatively stable, export-driven economies with transparent monetary policy. The Bank of Korea has maintained a cautious stance on interest rate changes, prioritizing inflation control while signaling support for capital markets. The Korean won has remained relatively stable, further reducing currency-related risk for global investors.

Additionally, South Korea’s close trade ties with both the U. S. and China — without being fully reliant on either — allow it to benefit from global tech decoupling while hedging regional exposure.

### IPO Pipeline and M&A Activity

The healthy performance of the stock market is fueling a fresh wave of initial public offerings (IPOs) and merger-and-acquisition (M&A) activity. Startups and mid-sized firms in the biotech, green tech, and e-commerce spaces are planning listings in the second half of 2025. Big-ticket IPOs expected later this year include: - **Kurly Inc.

** (online grocery delivery) - **Hanwha Qcells spin-off** (solar tech) - **Rebellions Inc. ** (AI semiconductors)

On the M&A front, Korean conglomerates are also looking abroad for acquisition targets in robotics, EV battery technology, and software-as-a-service (SaaS) platforms, further enhancing investor enthusiasm for globally diversified Korean firms. ### Risks Still Linger

Despite the optimism, analysts caution that the rally is not without risks: - AI bubble concerns: Some tech valuations are beginning to look stretched, drawing parallels to previous speculative cycles.

- Export dependency: A slowdown in global demand — particularly from China — could quickly dampen earnings forecasts. - Geopolitical tensions: Renewed hostilities with North Korea or trade conflicts with major partners could inject volatility. - Youth unemployment and debt: Domestically, rising household debt and stagnating youth employment remain long-term drags on economic momentum.

Still, many believe South Korea’s structural reforms and tech alignment offer a compelling medium-to-long-term growth story. ### Outlook: From Regional Player to Global Contender?

With a strategic position in the global supply chain, government-led modernization, and an energized investor base, South Korea’s stock market is being re-evaluated by asset managers and sovereign wealth funds alike. Some institutional players — including Norway’s GPFG and Canada’s CPPIB — have reportedly increased their Korea exposure in 2025.

U. S. investment banks are also revising upward their KOSPI year-end targets, with Goldman Sachs recently forecasting KOSPI 3,300 by December.

### Conclusion: Korea's Moment — and What Comes Next

South Korea’s stock market is no longer just an afterthought in global portfolio allocations. It has become a hotbed of innovation, reform, and investor activism. While risks persist, the convergence of macro strength, tech megatrends, and corporate transformation could make this more than a temporary rally — it could mark the beginning of South Korea’s emergence as a true heavyweight in global capital markets.